income tax returns filing online Deadline Extended to 31st October: What You Need to Know

Introduction

In a welcome remedy to taxpayers across the country, the government has extended the closing date for income tax returns filing online to thirty first October. This circulate comes as a respite for people and groups struggling to meet the preliminary deadline. In this text, we will discover the implications of this extension and offer important data for taxpayers to make sure a smooth submitting process.

Reasons Behind the Extension

The extension of the earnings tax filing cut-off date may be attributed to numerous factors. The ongoing COVID-19 pandemic has disrupted everyday life, inflicting delays in various financial sports. Many individuals and businesses confronted demanding situations in accumulating essential documents and records due to lockdowns and other pandemic-related regulations. To relieve the burden on taxpayers and offer them with enough time to record their returns appropriately, the government determined to increase the cut-off date.

Key Implications for Taxpayers

- Additional time for preparation: Taxpayers now have extra time to collect all of the required documents, which include earnings statements, investment proofs, and other monetary records. This extension gives a essential opportunity for meticulous evaluation, ensuring accurate reporting and minimizing the hazard of errors.

- Keeping off consequences: filing tax returns after the authentic cut-off date can cause consequences and hobby on the splendid tax amount. By way of utilising the extended closing date, individuals and corporations can avoid these extra monetary burdens and observe tax policies effectively.

- Reviewing Tax-saving Investments: The extension gives taxpayers with a chance to reassess their tax-saving investments. Via comparing their monetary portfolio, people can optimize their investments to maximize deductions beneath numerous sections of the income Tax Act, in the end lowering their taxable earnings.

- Seeking professional help: With the extra time, taxpayers can consult tax experts or chartered accountants if they require professional steering. Expert recommendation can assist in understanding complicated tax laws, figuring out eligible deductions, and ensuring accurate filing, thereby heading off ability criminal troubles inside the destiny.

- Encouraging E-submitting: The extended deadline serves as an possibility to sell e-submitting structures. On line tax filing portals offer convenient, consumer-friendly interfaces, guiding taxpayers via the procedure little by little. Encouraging e-filing can streamline the method, making it quicker and greater on hand for a larger variety of people.

Steps to make sure clean submitting

- Gather all files: collect all necessary documents, inclusive of shape sixteen, financial institution statements, funding proofs, and information of other sources of income. Make certain that you have accurate and up to date statistics.

- Overview Eligible Deductions and Exemptions: recognize the various deductions and exemptions to be had beneath the earnings Tax Act. Carefully evaluate your investments, expenses, and donations to perceive opportunities for tax savings.

Three. Make use of on line resources: Take gain of on-line resources supplied by the authorities and tax submitting systems. These resources consist of tax calculators, FAQs, and video tutorials that let you recognize the submitting method higher.

- Do not forget professional assist: in case you locate the method overwhelming or have complex economic situations, don’t forget looking for professional assistance. Tax consultants or chartered accountants can manual you through the manner and make sure accurate filing.

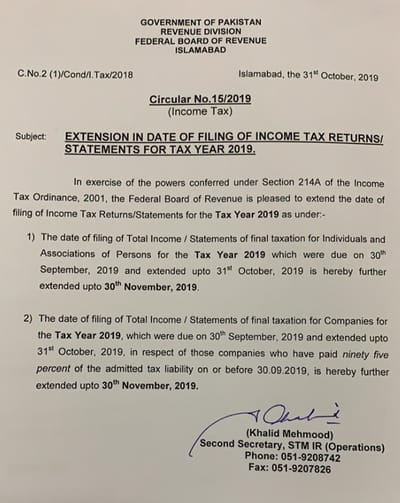

Read More: Filing Income Tax Returns and Statements for FBR

Five. Report Electronically: E-submitting isn’t always most effective handy but additionally ensures faster processing of your returns. Use cozy and reliable on line systems to report your income tax returns electronically.

Conclusion

The extension of the income tax submitting closing date to 31st October offers a treasured opportunity for taxpayers to document their returns appropriately and without pointless strain. By way of taking benefit of this overtime, individuals and agencies can make certain compliance with tax regulations, keep away from consequences, and make the maximum of available deductions. Proper practise, information of tax legal guidelines, and, if important, professional help could make the filing manner smooth and hassle-free. So, seize this opportunity, acquire your files, and report your earnings tax returns earlier than the extended cut-off date to stay at the right aspect of the regulation.

Income Tax Returns Filing Due Dates Extended

Read More: Professional Tax has deducted from the salary slip of an employee

|

| Income Tax Return Filing 2019-20 |